In today’s article, we will learn about Hindustan Zinc Share Price Target and also we will know how the future of this company can be and how much risk is there in this company? If you want information about all this then you will have to read this article carefully.

So without wasting much time, let’s start this article and know the complete information about Hindustan Zinc Share Price Target 2023, 2024, 2025, 2030 –

Complete information about Hindustan Zinc Limited (Hindustan Zinc Company Review )

Hindustan Zinc Limited is an Indian integrated mining and resource producer of zinc, lead, silver and cadmium. It is a subsidiary of Vedanta Limited. Hindustan Zinc is India’s largest and world’s second largest integrated zinc-lead producer. The company has a market share of over 80% in India’s primary zinc industry. Hindustan Zinc is also a major producer of silver with an annual capacity of 800 metric tons.

Hindustan Zinc was established in 1966 as a joint venture between the Government of India and Imperial Metal Industries of the United Kingdom. The company’s first mine, Zawar, was commissioned in 1969. Hindustan Zinc has since expanded its operations to include mines, smelters and refineries in Rajasthan, Gujarat and Karnataka.

Hindustan Zinc is a vertically integrated company, which means it controls the entire zinc-lead price range from mining to refining to marketing. This gives the company a significant advantage over its competitors.

Here are some key facts about Hindustan Zinc –

- Headquarters: Udaipur, India

- Employees: 23,000

- Products: Zinc, Lead, Silver, Cadmium

- Subsidiaries: Hindustan Zinc Alloys Private Limited, Vedanta Zinc Football and Sports Foundation, Zinc India Foundation, Anglo American Lishine Mining Limited

The financial figures of Hindustan Zinc are as follows –

| main point | Description |

| market cap | ₹1,35,844 crore |

| Share price as on 06 November 2023 | ₹297 |

| 52 week high level price | ₹383 |

| 52 week low level price | ₹288 |

| Stock P/E Ratio | 14.5 |

| dividend yield | 23.5% |

| ROCE (Return on Capital Employed) | 50.5% |

| ROE (Return on Equity) | 44.6% |

The share holding pattern of this company is as follows –

| shareholders | Total Share (in%) |

| promoters | 64.92 |

| Foreign Institutional Investors (FII’s) | 0.80 |

| Domestic Institutional Investors (DII’s) | 2.94 |

| Indian government | 29.54 |

| public | 1.79 |

Now we know in detail about Hindustan Zinc Share Price Target –

Hindustan Zinc share price target in 2023 (Hindustan Zinc Share Price Target 2023)

Hindustan Zinc is a company which gives good amount of dividend to its investors. This company comes under Vedanta Group. Zinc is a major metal used in various industries including construction, automotive, and electronics. Due to the continued growth of these industries, demand for zinc is expected to remain strong in 2023.

HINDZINC is currently undergoing a major expansion project, which is expected to increase its production capacity by 30%. This will help the company to meet the increasing demand for zinc and increase its profitability.

The company is expected to benefit from the increasing demand for zinc from the electric vehicle (EV) sector. Zinc is used in the production of EV batteries and the demand for EVs is expected to increase significantly in the coming years.

Considering all these reasons, if we talk about Hindustan Zinc Share Price Target 2023, then the first share price target of this company can be Rs 380 and the second share price target can be Rs 440.

Hindustan Zinc share price target in 2024 (Hindustan Zinc Share Price Target 2024)

Hindustan Zinc Share Price Target in 2024 is expected to be between Rs 470 to Rs 550. If we look at the trend of share price of this company, it is continuously increasing. This stock has given an excellent return of 25.46% in the last one year. Since 2006 till now, this stock has given multibagger return of 269.87%.

Hindustan Zinc has several cost advantages, including low-cost mines, captive power plants and a vertically integrated business model. These cost advantages allow the company to generate strong margins even in a challenging market environment.

Hindustan Zinc is taking several strategic initiatives to improve its performance and growth prospects. These initiatives include expanding its production capacity, investing in new technologies and expanding its product portfolio.

China is the world’s largest producer of zinc and lead, but production is expected to decline in 2024 due to environmental regulations. This will create an opportunity for Hindustan Zinc to increase its market share.

In such a situation, if we talk about Hindustan Zinc Share Price Target 2024, then its first share price target can go to Rs 470 and the second share price target can go to Rs 550.

Hindustan Zinc share price target in 2025 (Hindustan Zinc Share Price Target 2025)

Hindustan Zinc is making many future plans regarding its business, out of which some future plans of the company are as follows –

- Expanding mining and smelting operations : Hindustan Zinc plans to invest Rs 10,000 crore (about US$1.34 billion) over the next few years to expand its mining and smelting operations. The company aims to increase its zinc and lead production capacity by 25% and 30% respectively.

- Going Green : HZL aims to reduce its carbon emissions by 50% by 2030. The company is investing in renewable energy projects and battery-powered vehicles to achieve this goal.

- Silver Production : Hindustan Zinc is also considering increasing its silver production. The company plans to increase silver production from 800 metric tons to 1,000 metric tons by 2030.

- Expansion into new markets : HZL is looking to expand into new markets, especially in Asia and Africa. The company is also looking to expand its product range to include zinc-based alloys.

In such a situation, if we talk about Hindustan Zinc Share Price Target 2025, then the first share price target of this company in 2025 can be Rs 580 and the second share price target can be Rs 670.

Hindustan Zinc share price target in 2026 (Hindustan Zinc Share Price Target 2026)

Hindustan Zinc has many such projects which are currently under construction. If these projects of the company are completed on time, there can be strong growth in the company’s business. Some of the main projects of the company are as follows –

- 0.5 million tonne per annum (MTPA) fertilizer unit and 0.16 MTPA roaster plant : The fertilizer unit will be located in Rajasthan and will use zinc and lead concentrate from Hindustan Zinc mines. The roaster plant will be used to produce zinc oxide, a key component in batteries. The total investment on these two projects is estimated to be around Rs 2,200 crore.

- A new zinc smelter at Zawar : The new smelter will have a capacity of 1.5 MTPA and will replace the existing smelter, which is nearing the end of its life. The total investment on this project is estimated to be around Rs 1,500 crore.

- A new lead refinery at Dariba : The new refinery will have a capacity of 1.2 MTPA and will replace the existing refinery, which is nearing the end of its life. The total investment on this project is estimated to be around Rs 1,000 crore.

- Multiple Exploration and Development Projects : HZL is also investing in several exploration and development projects to find new sources of zinc, lead and silver. These projects are located in India, Australia and Canada.

Apart from this, the balance sheet of Hindustan Zinc also appears healthy. Hindustan Zinc has managed its balance sheet well. You can see the balance sheet of Hindustan Zinc through the image given below –

Considering all these reasons, if we talk about Hindustan Zinc Share Price Target 2026, then the first share price target of this company can be Rs 710 and the second share price target can be Rs 780.

Hindustan Zinc share price target in 2030 (Hindustan Zinc Share Price Target 2030)

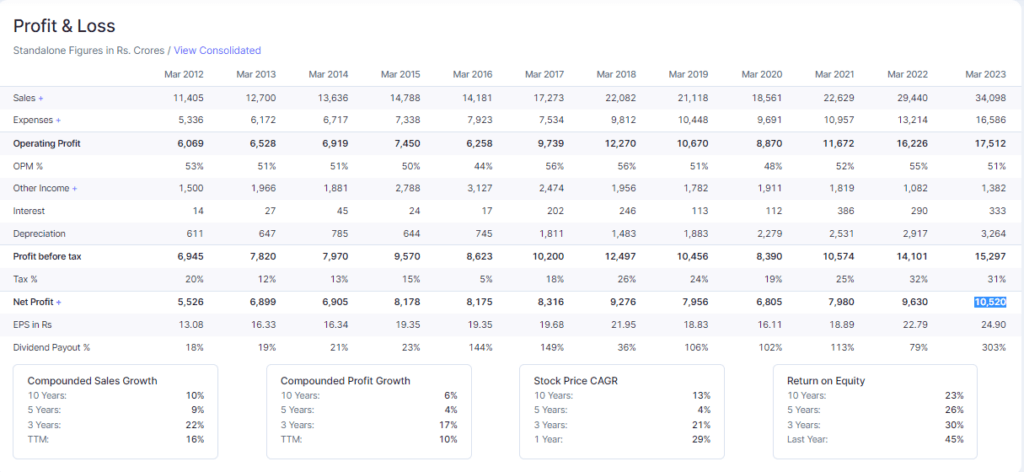

The sales and net profit of the company are continuously increasing. If we look carefully at the company’s sales, it is growing year after year. The total sales of this company were Rs 22,629 crore in March 2021, which increased to Rs 29,440 crore in March 2022. Now the total sales of this company in March 2023 are Rs 34,098 crore.

The net profit of the company is also showing good growth. The total net profit of the company in March 2021 was Rs 7,980 crore. Whereas in March 2022, its net profit had become Rs 9,630 crore. Now in March 2023, the total net profit of this company has become Rs 10,520 crore.

For more information, you can see the profit & loss account of the bank in the image given below –

In such a situation, if we talk about Hindustan Zinc Share Price Target 2030, then the first share price target of this company can be Rs 1450 and the second share price target can be Rs 1550.

Hindustan Zinc Share Price Target 2023, 2024, 2025, 2030 in Table

| Year | First share price target | Second share price target |

| 2023 | 380 | 440 |

| 2024 | 470 | 550 |

| 2025 | 580 | 670 |

| 2026 | 710 | 780 |

| 2030 | 1450 | 1550 |

Future of Hindustan Zinc Share

Hindustan Zinc is a leading zinc producer in India with a strong track record of profitability. The company has a number of factors that could contribute to a positive future for its share price, including –

- Strong Demand for Zinc : Zinc is a major metal used in various industries including construction, automotive and electronics. The demand for zinc is expected to increase in the coming years due to increasing global economic activity and increasing use of zinc in new applications.

- Low Production Cost : Hindustan Zinc has low production cost compared to other zinc producers. This gives the company a competitive advantage and helps it earn strong profits even when zinc prices are low.

- Dividend Yield : Hindustan Zinc’s dividend yield is around 4%. This makes the stock attractive to income investors.

- Bullish Potential : Hindustan Zinc’s current share price is below analysts’ consensus target price. This shows that the stock is likely to rise in the near future.

Overall, Hindustan Zinc is a well-managed company with a strong track record of profitability. The company has a number of factors that could contribute to a positive future for its share price.

Risk in Hindustan Zinc Share

Hindustan Zinc is a major zinc and lead producer in India. The company has a strong track record of profitability and has maintained a healthy ROCE over the past few years. However, there are some risks associated with investing in Hindustan Zinc shares.

Some of the major risks to consider include –

- Commodity price volatility : The price of zinc and lead is volatile and can be affected by many factors such as global economic growth, supply and demand and weather conditions. This may cause fluctuations in Hindustan Zinc’s earnings and share price.

- Environmental Regulations : The company is subject to extensive environmental regulations relating to emission norms, waste discharge and waste management. Non-compliance with these regulations can result in fines, penalties or even suspension of operations.

- Supply chain disruptions : Hindustan Zinc is a vertically integrated company, meaning it owns and operates its own mines and smelters. However, the Company is also dependent on third-party suppliers for certain raw materials and services. Disruptions in the supply chain could affect Hindustan Zinc’s ability to produce and sell zinc and lead.

- Political Risk : India is a politically unstable country and there is always a risk of change in government policy which could adversely impact Hindustan Zinc’s business.

Overall, Hindustan Zinc is a well-managed company with a strong track record. However, there are some risks associated with investing in company shares. Investors should consider these risks carefully before making investment decisions.